Member countries of the Organization of Petroleum Exporting Countries (OPEC) failed to reach a consensus to put a ceiling to the group’s daily output on December 4.

The members therefore decided to stick to OPEC’s policy of producing oil as much as possible to squeeze out unconventional, non-OPEC producers.

Shana held an interview with Mehdi Asali, Iran’s national representative to OPEC, to review the meeting’s outcomes.

What follows is the interview:

-What went on at the 168th meeting of OPEC member countries (MCs)? How should the meeting’s outcome be interpreted as analysts believe it favored the stance of Saudi Arabia and its allies?

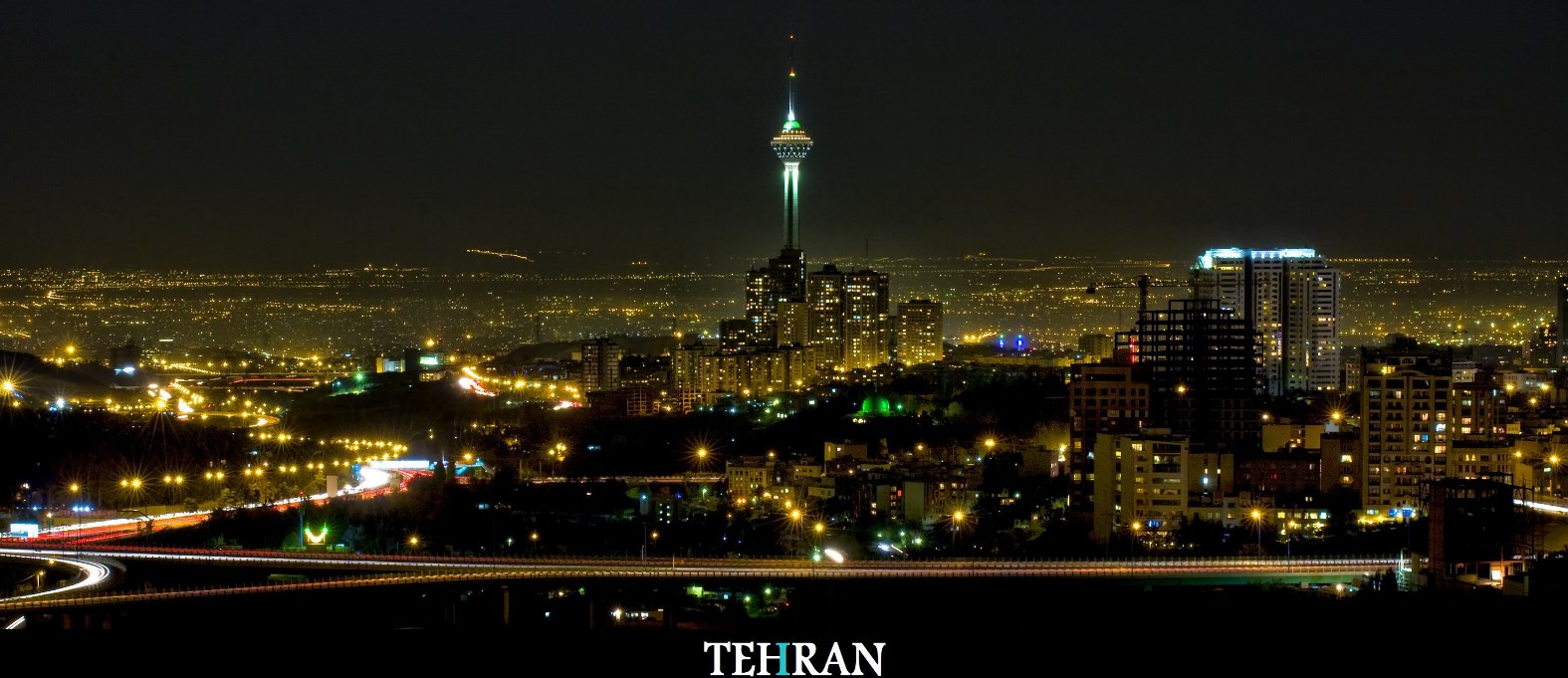

The outcome of the meeting was already anticipated before it convened on December 4; the MCs did not agree to set a new ceiling for the group’s output; but regarding the stance of Saudi Arabia, one can say the meeting’s outcome was completely opposite to what would favor the intentions of Riyadh and its Persian Gulf allies. As you saw at the end of the meeting, the Saudi oil minister did not endorse the group’s decision as he did so in the previous editions of the meeting. On the other hand, the meeting’s outcome should be viewed as a relative success for Iran given the country’s growing international influence after it reached a historic nuclear accord with the P5+1 group of countries in July. Ass to the deal, the successful arrangement of the third summit meeting of Gas Exporting Countries Forum in Tehran which reinstated an Iranian at the helm of the forum for a second two-year term. Let us not forget that the presidents and heads of state of some OPEC MCs are also among the permanent or observing members of the forum which also saw the attendance of OPEC Secretary General in Tehran on November 23. During the Tehran summit, discussions were also raised about the global oil market and the new OPEC secretary general.

It was evident throughout the recent OPEC meeting that Iran’s role in the group, which had been dramatically diminished, as a result of the country’s limited supply to the global markets because of the sanctions, had intensified as some key MCs underwrote Tehran’s stance regarding OPEC’s production policy or at least abstained from voting against it. The meeting’s outcome will allow Iran to raise its role in the group by pumping more oil to the market after the sanctions removal and bring the organization back to its golden days in the market.

To have a thorough interpretation of the meeting’s outcome, OPEC’s developments must be viewed from a wider standpoint. Undoubtedly, the current circumstances are clearly against the interests of OPEC MCs as they have lost over $500bn of their oil revenues in the current bearish crude oil market since 2014 without any changes in the market shares of the MCs. As a matter of fact, those countries that produced more oil since the price slump started, lost more revenues. This did in fact weaken support for Saudi Arabia’s market strategy during the meeting and this is while Arabia and its allies keep saying they would reduce their market supply only when other OPEC members including Iran and Iraq, and non-OPEC producers, especially Russia, curb their supply.

-Who is accountable for the current volatile market?

Production from non-OPEC and unconventional producers has not declined ever since the group took its current policy of not reducing output, unlike what Saudi Arabia had reasons for maintaining record high supplies and the prices have not stopped lowering in a manner that they are wreaking a havoc on OPEC producers’ economies. All this led to weakening support for the Ale-Saud’s OPEC initiative putting the country under pressure to take a measure to stabilize the market. This is why a few days before the meeting, there were rumors that Riyadh would decrease its supply as much as a million barrels per day provided that other major producers including Iran, Iraq and Russia reduce their market supply. The rumors were denied by Saudi officials only after the meeting’s outcome was released and the Saudi government saw that things did not go as it wished they would.

In its December issue, Petroleum Intelligence Weekly published an in-depth assessment of the new Saudi strategy in the energy market. The article makes it clear that the meeting went exactly opposite to what Saudis had wished for, however, the meeting’s outcome was not the best that could have otherwise been agreed upon by OPEC MCs. The article argued that the best outcome of the meeting in order to rebalance the market, would be reduction of output by only those members that had increased their supply ever since December 2011, to minimize the impact of Iran’s return to the market after the sanctions removal by opening room for fresh crude oil supplies from Tehran. The report also said that Saudi Arabia’s market strategy relies heavily on its low production costs compared to that of non-OPEC, tight oil producers; Saudi Arabia is using the low cost of its production as a lever to drive unconventional producers out of the market. However, the strategy has proved ineffective so far and this is why Arabia is trying to gain some support within OPEC and outside of the producing group by calling on them to reduce their output to some degree. The Saudis say they would reduce their production only if Iraq observes its production quota in the organization and Iran agrees to defer its intended production rise after the removal of sanctions.

As a new strategy to reduce its crude oil inventories, Saudi Arabia has decided to consider reduction of its production which is viewed by analysts as an efforts by Riyadh and its fellow allies to maintain their traditional role in rebalancing the market; this was clearly mentioned at OPEC’s summer meeting by oil officials of these countries and the organization decided not to slash its oil output despite sliding prices at a time that Iran is expected to increase its production next year. This was rumored by Saudis themselves to have some kind of a bargaining chip for leading negotiations at the Dec. 4 meeting with other OPEC members. However, it is evident that Saudi Arabia has altered its stance since last summer. Sliding oil prices which have gone below what the Saudis had expected as a result of sustainable production from major non-OPEC producers and the possibility of further slump in the following months, have prompted Riyadh and its allies to start off measures to keep the prices at the 50-60 dollar area. The reports issued by OPEC secretariat and unofficial remarks before the group’s meeting indicate that an agreement is being reached by the MCs to reduce the group’s daily output by 1.5m bpd in 2016. This could be some good news but the point is that, all those countries that made fortunes by pumping more oil to the global market when the prices were the highest level in the history of the industry as Iran and Libya had to reduce their output due to certain reasons, are now calling on all OPEC MCs to pay the price of rebalancing the market. Anyway, now that shale oil production as well as other unconventional methods for extraction of oil are thriving even at low crude oil prices, it turns out to be harder for OPEC to retain its traditional role to adjust the market; the organization needs to adopt a smarter strategy both in upstream and downstream sectors in order to secure its market share while keeping the prices at an acceptable level. Too much supply cuts by OPEC can cause serious fluctuations in the market which is not favored by either producers or consumers. The reason is that a sharp price growth allows unconventional producers to drill more tight oil wells in a relatively short period of time leading to more supply to the market, less market share for OPEC countries and the subsequent falling of prices.

-So it is clear which countries are responsible for the market’s current status. It is the same countries that have imposed flawed policies on the organization in the past two years incurring billions of dollars of losses on the producing group. Now could Iran have acted in a better way or not?

Ever since 2014 that the prices began to slash due to market oversupply caused by booming shale oil production, Iranian Minister of Petroleum has started calling on other OPEC members including supporters of the Saudi market policy to reduce their output and respect the OPEC 30m bpd production ceiling (which was agreed upon by the members in 2011 before the sanctions were imposed on Tehran). Some OPEC members boosted the group’s output to over 31.5 million bpd while the market demand for OPEC oil is nearly 29m bpd. It is clear by OPEC secretariat reports and other sources which countries have aggravated market volatility by boosting their output during the past 18 months. In response to the calls by Iran and other OPEC members like Venezuela and Algeria to cut production, Saudi Arabia said it would reduce its output only if other OPEC members and non-OPEC producers including Russia cooperated. According to OPEC memorandum of articles, the MCs cannot hinge OPEC policies on non-OPEC behaviors to regulate the market and curb price slumps. Iran has officially announced that it could not withhold its intentions to boost output after the sanctions removal and called on the countries who took over its markets during the sanctions years to reduce their output to make way to new Iranian supplies in order to prevent the market from becoming volatile because of Tehran’s return to global markets. However, Iran’s calls were denied by Saudi Arabia and its allies in the Dec meeting. Aside from political reasons, OPEC made a historic mistake to abandon the quota production of the member countries in 2011.

As a matter of fact this was primarily masterminded by Saudi Arabia and its allies to rationalize their oversupply in order to implicitly overtake the market shares of Iran and Libya which were expected to reduce their output because of the sanctions on one and internal tensions in Tripoli. Despite the announced aim of introduction of OPEC ceiling was to bring Iraq into the quota system of the organization, neither Baghdad nor the December 2011 meeting of the group endorsed this. By and large, that decision was a historic mistake which allowed Saudi Arabia and its allies to raise their output without being blamed to violate their quota.

-What were Iran’s positions in the recent meeting? There are allegations that Iran has not been strong in OPEC meetings including the recent one.

The positions adopted by Iran in the recent meeting were in line with the previous calculated stances in the last two years which I explained. In the recent meeting, there was an impression that Saudi Arabia and its affiliated countries were set to increase OPEC’s official production with the pretext of Indonesia’s rejoining the organization (This issue which was later denied, was initially leaked to the international press by Nigeria’s delegate when at OPEC’s semi-ministerial meeting it turned out that Saudi Arabia’s plan will not be accepted) so that with the official production increase, they could cover up their production in the recent years. Nevertheless, Indonesia’s return to OPEC will not change the actual production. In fact, an accounting adjustment from OPEC’s increased production (of Indonesia’s output around 800,000 barrels) and reduced production of non-OPEC will be evenly balanced. If their sincere objective was correction of the past behavior and creating stability in the oil market, they should have brought down the actual output to the approved ceiling of 30 million barrels one or two months prior to the meeting acting on Iran’s invitation (calling members) to observe the official ceiling. Next, with Indonesia’s membership, OPEC in the upcoming meeting could announce the addition of that country’s production accounting to OPEC’s output without Indonesia and also its deduction from non-OPEC production. For this reason, Iran and some other member states opposed official production increase considering the market surplus and reiterated their call for observing production at the official ceiling level.

An additional demand of these countries on curbing Iran’s oil production increase after removal of sanctions because of the market surplus was strongly rejected by Iran. In fact, their call was aimed at imposing new sanctions on Iran’s oil sector by these countries so that they can prevent development of our oil production capacities. It has been repeatedly announced by the honorable minister and other officials of the Ministry of Petroleum that Iran’s production increase to the pre-sanctions level is the natural and non-negotiable right of the country and that the countries which with their increased production have caused the supply surplus above OPEC’s official ceiling have to reduce their production. It should be noted that these countries have not only seized Iran and Libya’s quotas in the oil market, but they have also totally produced 1.5 million barrels above the permitted level which is set in the official ceiling. In other words, these countries are collectively supplying about 4 million barrels above their December 2011 production, and, currently, they are not ready to reduce a portion of their increase production in order to help the market to reach a balance. Therefore, from a fair outlook, no fault can be attributed to Iran’s positions which were taken on the production ceiling and production management in the recent meeting.

-Election of secretary general was another challenging issue of the meeting. What was Iran’s stance?

Iran’s stance on secretary general was absolutely correct. Prior to the OPEC meeting and during the summit of Gas Exporting Countries Forum (GECF), a number of countries had expressed their objection to continued office of the organization’s current secretary general. In addition to remaining in office for more than two three-year terms by Mr. El Badri, some countries believed that the secretary general could not perform at the expected level and that he has not observed impartiality among the members. In other words, he has attempted to give more weight to the views of certain countries in OPEC’s decision-makings and to justify them. Therefore, a number of member countries called for the election of a different person who may also be younger as the OPEC secretary general. Iran, which has officially nominated for the position of secretary general but has not have the possibility of taking the position due to the objection of certain countries, tried to support the best persons available in the member states whose stands have been close to Iran. However, because these persons were either reluctant or could not accept the proposal or were not nominated by their respective governments, there was no option but to assign the current secretary general as OPEC Secretariat’s acting head for few months and attempt to assign an impartial and outstanding person in the next meeting.

Comments are closed.