With the advancement in the technology of Liquid Natural Gas (LNG) infrastructure and the ease of transportation and storage of natural gas, many countries are on the quest for developing the technology needed for this clean source of energy.

The establishment of a spot market for LNG has further given potential for the development of this industry.

Worth mentioning is that today we are witness to weather anomalies all over the world. Such abnormal weather condition is blamed on the effects of CO2 emissions on climate change, the effects of which we see today in North and South Americas, Europe and other parts of the world.

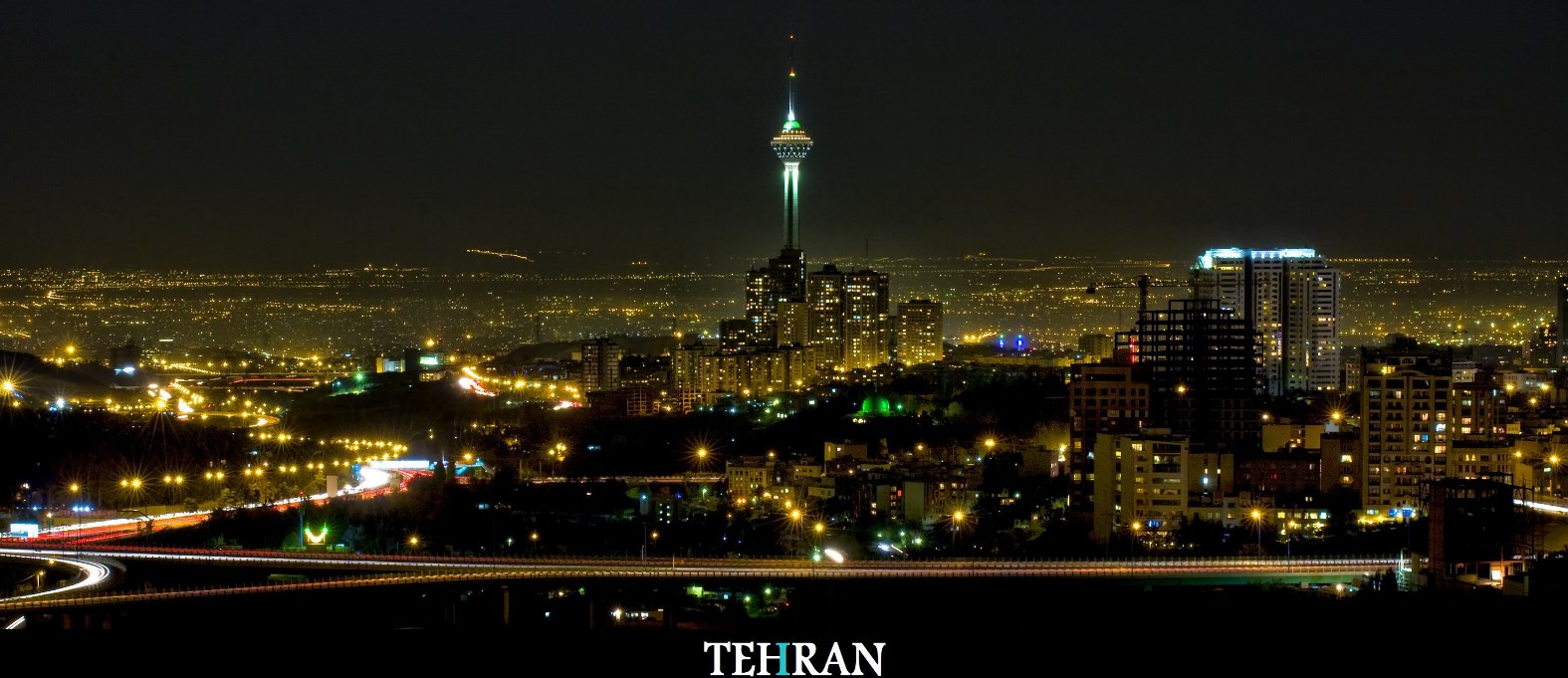

On a micro scale pollution is blamed on inefficient modes of transportation and overcrowded cities, like Tehran and other mega cities.

Before delving in the advancements and strives made by the Islamic Republic on its quest for LNG technology, let’s have a look at what some other countries are doing and their present status:

WIND-LNG POWERED CARGO FREIGHTERS:

Today international shipping is transporting 90 percent of all goods on earth. Cargo freighters run on heavy fuel oil and contribute heavily to pollution. To make ships more eco-efficient, engineers have been working with alternative fuels.

A Norwegian engineer, Terje Lade, is currently pursuing a new approach with a ship called VindskipTM, which translates to windship. Lade has designed a cargo ship (see photo) that is powered by wind and gas.

Software for the cargo freighter is developed by Fraunhofer to optimize available wind at any time. The software was handed over to the company Lade AS in mid 2015.

‘With our weather ro0.uting module the best route can be calculated in order to minimize fuel consumption,’ said Laura Walther, researcher for the software at CML in Hamburg.

‘After all bunker expenses account for the largest part of the total costs in the shipping industry,’ added Walther.

Due to its low consumption the vessel can utilize LNG as fuel to be capable — in the worse case — of 70 days of steaming between bunkering.

The cargo freighter is able to travel as fast as conventionally powered ships, i.e. 18-19 knots.

JORDAN’S FIRST LNG TERMINAL AT AL AQABA:

Jordan’s first LNG terminal started importing LNG earlier this year via Floating Storage and Regasification Unit (FSRU) Golar Eskimo. The operational FRSU projects are based on conversion of an existing LNG career.

The company behind this project, FSRU is the world’s largest independent owners and operators of LNG carriers with over 30 years of experience. The company is planning to grow its business further upstream with the development of Floating Liquified Natural Gas (FLNG).

Early December due to winds Golar Eskimo had to be moved away from the jetty causing disruption of gas supplies to National Electric Power Company of Jordan (NEPCO). As a result of bad weather there was a disruption of electricity supply.

Being connected to the national gas grid, FRSU delivers fuel to power plants through out Jordan and also to the Egyptian Natural Gas Holding (EGAS) via pipeline.

NEPCO informed last week (before Christmas) al Aqsa LNG terminal was operating in full capacity. The terminal has a capacity to store 160,000 cm of LNG and delivering up to 500 mcmfscd with a peaking capacity of 700 mnfsc.

QATAR LNG HEADING TO BELGIUM:

Qatar has been the world’s largest exporter of LNG since 2006, with 31 percent of global market share in 2014. However, now it’s LNG production has plateaued and could even begin to decline. The country has put a moratorium on some of its fields.

The Al Marrouna LNG Tanker (built 2006 with a capacity of 151,700 cm) departed from Qatar Port of Ras Laffan on Dec. 24 and expected to make delivery in Belgium’s new terminal in Zeebrugge on January 12, after an 18 day journey.

Zeebrugge, mainly LNG port, has an annual thoroughput capacity of 9bcm of natural gas.

INDIA’S KOCHI LNG TERMINAL AWAITS QATARI CARGO:

Kochi LNG regasification terminal is located in Special Economic Zone of Puthuvypeen near the entrance to Cochin Port. It was constructed and commissioned in August, 2013.

The terminal has been developed by Petronet LNG having the capacity to store and distribute 5-million tons of natural gas per annum.

The jetty is designed to receive LNG tankers between 65,000-216,000 cubic meters and contains two LNG storage tanks each with a capacity of 155,000 cbm.

FRENCH FIRM TO PROVIDE LNG VESSEL BUILDING TECHNOLOGY TO INDIA:

Cochin Shipyard Ltd. has signed an MoU with Gaztransport & Technigaz (GTT), a world leader in design and engineering of containment systems for maritime transportation and storage of LNG.

The shipyard in India is the first to be licensed by GTT which holds patent technology for building LNG ships. No Indian shipyard has made LNG career yet, which costs over $200 million.

In scope with an energy transition towards a cleaner energy, such as LNG, India will need careers with latest technology.

The IranOilGas Network reported that India is willing to take stake in ‘Iran LNG’ project. The LNG terminal is based at Tombak Port, approximately 50 kilometers north of Assaluyeh Port will be equipped with storage and loading facilities.

PETROCHINA’S TERMINAL RECEIVES 1ST LNG CARGO:

PetroChina’s Dalian LNG receiving terminal, its second and China’s fifth, received its first LNG cargo on Dec. 23, reports Reuters.

Dalian LNG terminal is located in northwestern Leaoning Province and China National Petroleum Corp. (CNPC) is its parent company. According to the reports Dalian will mainly take LNG from Qatar, Australia and Iran.

PetroChina started in May its first LNG terminal in east China’s Jiangsu province.

EGYPT LATE WITH LNG PAYMENTS:

Reuters reported that Egypt has asked LNG suppliers to extend the term another 90 days after a delay in the payment of $350 million in debt. According to existing arrangements, Egypt is obliged to pay for LNG imports 15 days after a cargo unloads.

Egypt imports around six to eight cargoes of LNG per month, valued at around $20 million to $25 million per cargo, reports Reuters.

Its suppliers include BP, Shell, Gas Natural, Trafigura, Vitol, EDF Trading, PetroChina and Noble.

The second LNG terminal was recently inaugurated. It was sent by Singapore-based Norwegian group BW Gas, has a capacity of 600 to 700 million cubic feet per day.

Egypt has emerged as a major new market for LNG as the government looks to ease the worst energy crunch in decades.