Turkey’s brokerage and advisory firm Unlu Yatirim says it is in talks with an Iranian company for a joint venture in the country which is opening to business with imminent removal of sanctions.

The Istanbul-based firm will offer brokerage services in Iran and set up a hedge fund for investments in Iranian fixed income and stocks, its chairman Mahmut Unlu says.

The fund will initially start with about $50 million and increase it depending on subscriptions, Unlu told Bloomberg.

Unlu said he has received permission from Iranian authorities to establish a brokerage by itself if the venture talks with the unnamed Iranian firm fail.

The company will soon begin to provide equity research for listed Iranian companies for its international clients, he added.

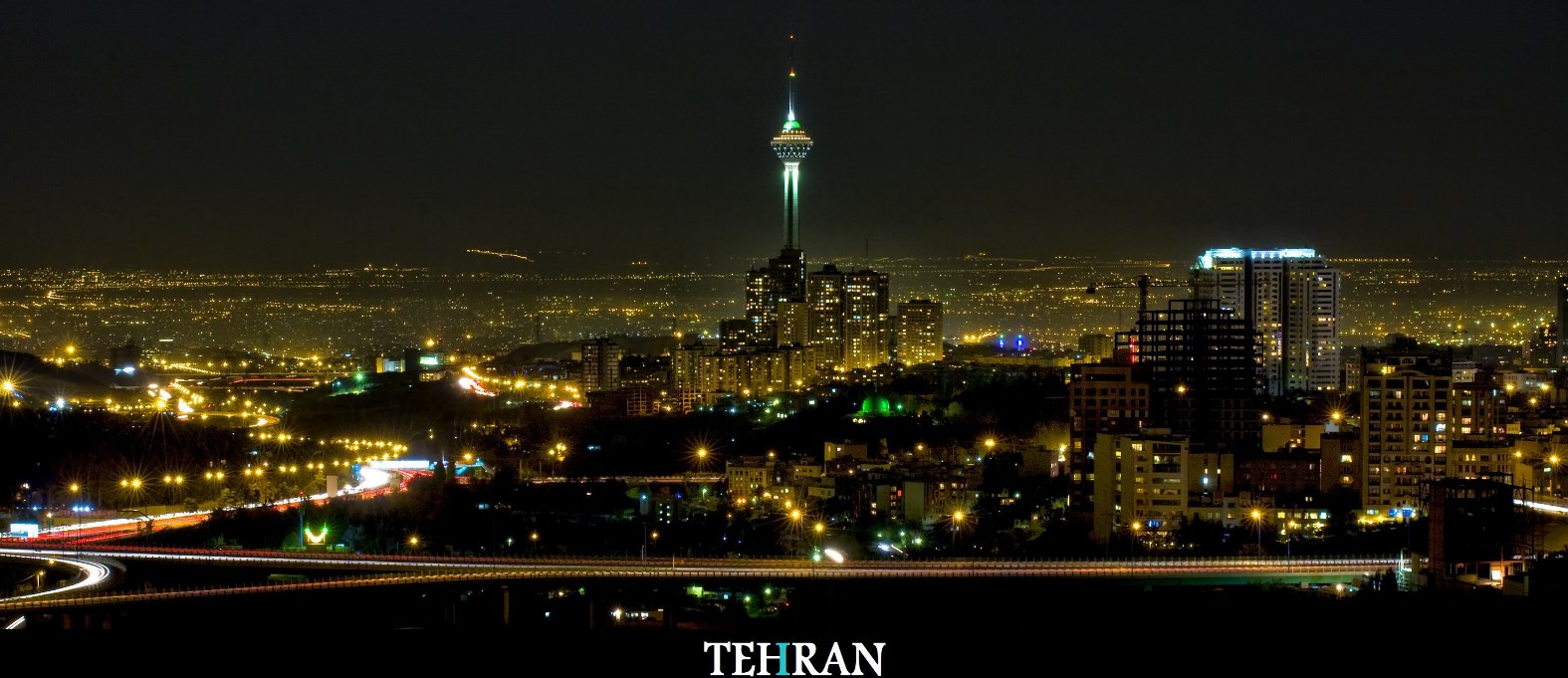

Investment managers from Russia, Britain, Egypt, Greece, Switzerland, the US, Turkey, Italy and the UAE have visited the benchmark Tehran bourse where about 400 financial entities are listed with a market capitalization of some $100 billion.

Interest is building up in the Iranian stock market as new entities are waiting for initial public offering, including refineries, petrochemical plants and other big businesses.

London-based Charlemagne Capital and First Frontier Capital would rather jump the gun than get lost in a possible march on Iran, becoming the first foreign firms to send delegations to the Tehran Stock Exchange to test the waters.

First Frontier has already tied up with an Iranian investment banking firm, The Agah Group, to provide research on the country’s leading companies.

Economists say Iran has all the classic underpinnings of a frontier market prime for growth, including a large and well-educated young population. It is the only country in the top 30 global economies closed to global investors.

The impending removal of trade sanctions on the Islamic Republic presents tremendous investment potential.

Relief from sanctions could triple Iran’s economic growth rate, by eliminating restrictions on shipping Iran’s oil exports to the global market, while ending the nation’s restraint from the global financial and banking systems.

Economists project an annual growth rate of 6-8% when the sanctions are totally voided.

“We are very hopeful, based on information from Iranian officials and international nuclear monitors, that sanctions will start to be removed from late January or February at the latest, if everything goes as planned,” Unlu said.