Join The Ultimate And Irreplaceable Experience Now.

Just define your interests, We will promote the best investment opportunities for you

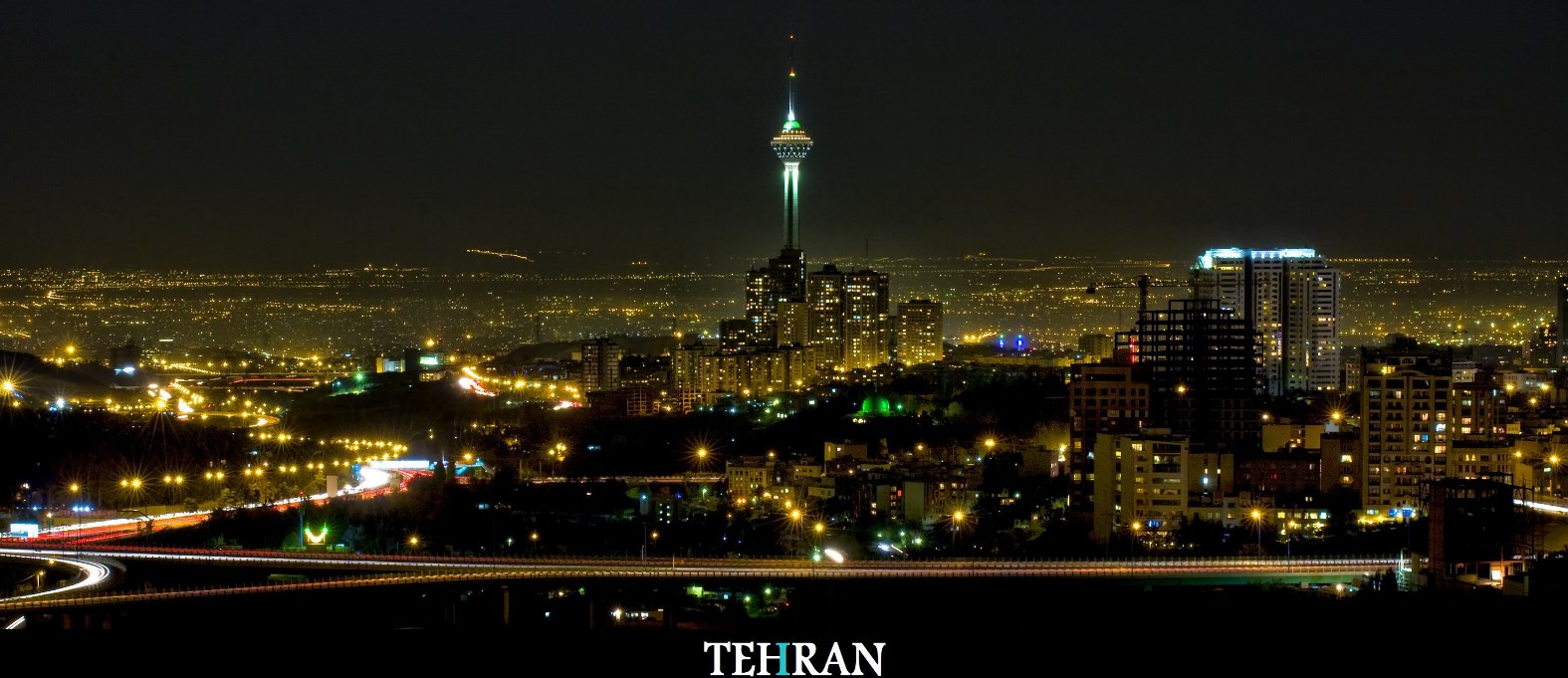

Iran qualifies from many respects to be a good location for investment and doing business. it has huge potential for investing after the termination of economic sanctions, Some of the features are highlighted below:

1. Vast domestic market with a population of 80 million growing steadily

2. Young, educated and cheap labor force

3. Excellent strategic geographical position

4. The quick and easy access to neighboring markets with a population of 350 to 400 million

5. Developed and ready infrastructure

6. Cheap and abundant raw materials, energy and transportation

7. The four-season climate and climate variability in the country

8. Fiscal incentives

9. Security and political stability

10. Untapped and consumer market ..

He made the remarks in a meeting with visiting Minister of Roads and Urban Development Abbas Akhundi.

AIIB president referred to Iran’s role in establishment of the AIIB and said this bank is ready to finance Iran’s infrastructure projects.

AIIB is ready to help Iran to rebuild the decayed residential places, he added.

During the meeting, the Iranian minister for his part expressed Iran’s interest to use the AIIB finance for development of its infrastructure in various sectors of air, rail and road.

Iran prefers using the Build–operate–transfer (BOT) and BLT (Build–Lease–Transfer) forms of project financing to finance its projects, he added.

The official urged AIIB to dispatch a delegation to visit Iranian projects.

Akhundi is in China for a four-day official visit to discuss cooperation between the two countries in the field of transportation. Heading a delegation, he arrived in Beijing on Sunday evening.

The parties to the talks on Monday for future cooperation between the two sides were senior directors of Berliner Handels- und Frankfurter Bank (BHF-BANK), especially governor of the Bank Hans- Günter Wiesenack, and Deputy Minister of Industries, Mines and Trade of Iran and Chairman of the IMIDRO Mehdi Karbasian on Monday.

Wiesenack said there are abundant opportunities for mutual cooperation and his bank wants to expand financial relations with Iran.

He recalled difficulty of ties with Iran during sanctions and said gone is the hard era and now the two sides can have good ties.

He suggested 30 to 40 years of cooperation with the Iranian IMIDRO.

Karbasian for his part referred to inking of documents for cooperation between Iran and a number of European companies and removal of problems with French Kofas and German Hermes companies and said many past financial challenges are now tackled.

The Iranian mining and mineral sectors will have many projects for development in the next five years and the banking sector and financial and insurance sectors will be of special importance for the purpose, said Karbasian, adding that Iran has defined 30 billion dollar project for the mine and mining industries and is ready to absorb the capital in order to finance the projects.

Alimorad, briefing a press conference on petrochemical investment and financing, said the investment and capital attraction and financing projects will take time. ‘In the post-JCPOA era, the policy of Iran’s National Petrochemical Company is using the opportunity available to encourage foreign investors to invest in the petrochemical industry, thus attaining the world’s latest technology.’

To this end, strengthening Iranian investors through establishing partnership company structures will be among priorities of the NPC, he added.

Alimorad referred to a guideline issued by Minister of Petroleum Bijan Zanganeh regarding foreign investment and said all Iranian and foreign investment bids should be examined by the NPC and after their confirmation, the result should be sent to Ministry of Petroleum for issuance of early permit for investment.

Elsewhere in his remarks, he referred to an agreement, signed with the Japanese for a credit line of 10 billion euros, and said despite lapse of six months since inking of the agreement, the two sides’ conditions have not become much similar to open the line.

He noted that concurrently, other credit lines will be issued by the Central Bank of Iran and Ministry of Economy and Finance with two or three European states, China and Korea and any of them opened, will be the Iranian party’s priority.

Alimorad also referred to a credit line of 320 million euro by Japan in usance form for Persian Gulf Holding company and said for the time being, talks are underway with a Japanese company for better conditions to open a credit line of 640 million euros.

He also outlined a joint meeting of Iran and Germany at Iranian Embassy in Berlin to attract investment, have partnership of companies, banks and insurance institutes and said in the meeting managing directors and senior directors of petrochemical companies and holdings active in Iranian petrochemical industry introduced their major projects.

The official said the meeting aimed to find a suitable mechanism for using Germans’ credit lines. ‘The project the German banks considered as the speedy way consisted financing one or two projects relating to NPC regarding its being state-owned, so then the private sector projects will be financed.’

‘The NPC will avoid providing government guarantees for projects and we believe not to deal with projects with respect to their nature.’

Alimorad said Germany’s current credit line is three billion euros in value and it is predicted will rise up to the ceiling of six billion euros but Iran is in talks for more six billion euros in addition to the three billion euros credit line.

He said, ‘We use many methods of investment and financing petrochemical projects. To this end, a foreign company is to provide 200 million euro finance for project of a private company. Any success to activate even a credit line of 100 million euro for Iran on part of German Hermes, we will be able to change international atmosphere and prepare the ground for major credit lines with other companies.’

Jean-Marie Hoornaert who had a trip to Iran to take part in Iran-Belgium Trade Conference and B2B negotiations, told IRNA that Iran’s 80-million market which has become available after the implementation of JCPOA can’t be ignored and Belgium is seeking for long-term trade ties with Iran.

Hoornaert said that Coris BioConcept had no relations with Iran during sanctions era but now is ready to have cooperation in introducing new products.

Deputy Minister of Industry, Mine and Trade Mojtaba Khosro Taj said that the trade exchange volume of Iran and Belgium is 300-400 million dollars per year and attempts should be made to boost the figure to over $1b.

Coris BioConcept is a middle-sized company (SME) specialized in developing, manufacturing and marketing rapid diagnostic tests.

Iran-Belgium Trade Conference was held with the attendance of some 140 Belgian firms on October 30 in Tehran, Iran.

Directors of National Iranian Gas Export Company and senior directors of Oman Ministry of Petroleum met with the envoys of French Total, British Royal Dutch Shell and KOGAS discussed Iranian project for gas exports to Oman.

Based on a 2013 deal between Iran and Oman, Iran will export 1.5 million cubic feet of gas to Oman through a Persian Gulf seabed pipeline.

Regarding its importance, the project will boost Iran-Oman ties and energy ties in the Middle East.

Iranian and Omani ministers of petroleum late August signed a Memorandum of Understanding for natural gas exports with regards to the emphasis of Iranian President Hassan Rouhani and Omani King Qaboos.

Akhundi and Xiaopeng underlined enhancement of relations in fields of rail and road transportation and the infrastructure.

The Iranian road minister referred to China cooperation with Iran in electrification of the Tehran-Mashhad railway and construction of Tehran-Qom-Isfahan High Speed Rail and called for revival of modern Silk Road.

He urged the Chinese side to help finance and execute the projects and invited them to attend the tender for development of the third phase of Shaheed Rajaei Port and Imam Khomeini Airport in Tehran.

Iran and China can get connected through rail and sea ways, the official said.

During the meeting, Xiaopeng for his part referred to Iran-China historical relations through the Silk Road and called for development of all out ties between the two countries.

The official encouraged execution of mutual contracts inked between Tehran and Beijing particularly the cooperation documents signed for boost of transportation between the two states.

Akhundi is in China to discuss cooperation between the two countries in the field of transportation. Heading a delegation, Akhundi arrived in Beijing on Sunday evening.

Akhundi will meet his Chinese counterpart, China’s deputy prime minister as well as the top officials of Exim Bank of China and the Asian Infrastructure Investment Bank (AIIB) during his four-day stay in the country.

He will also meet with Iranian traders residing in China on Tuesday. Akhundi will also pay a visit to Shanghai transportation infrastructure.

Speaking to IRNA, Production Manager of Pengg Kabel Company Gerd Pichler said that competition with China is the European company’s big challenge to enter Iran’s market.

Despite their low-quality, the Chinese products are cheaper than their European rivals, Pichler added.

He said ground is ready for inking agreements with the Iranian companies and Pengg Kabel Company has already talked with three Iranian companies for transfer of technology and export of its products to Iran.

‘The problem of transferring money has been already resolved and our company looks for suitable partners in Iran,’ the official added.

Iran-Austria trade forum was held in Nov 17 in Tehran and Gerd Pichler was one of the guests.

‘Because of its regional connections, Iran has successfully created a large market with around 400 million consumers,’ Zarif told a gathering of Iranian and Slovakian businessmen.

‘As a big member country of the European Union, Slovakia maintains a large economic growth,’ he said.

‘This is the same about Iran as the country also has a significant economic growth,’ the top diplomat said.

When the new government in Iran took office, it managed to increase the economic growth in the face of the Western-imposed sanctions which have been removed in the wake of the nuclear deal , Zarif said.

‘We achieved a great success,’ he added.

In spite of sanctions, we tried to manage our economy and we could decrease inflation from 45 percent to two-digit figure, the foreign minister said.

We expect our economic growth, once tended to be at minus 7 percent, to stand at around five percent, Zarif said.

The great achievement is going to take place in the year 2017, he said.

Zarif added that we are the only oil-producing country, which could withstand reduction of oil prices with no serious effect on the economy.

Iran is a high potential country, it has huge oil and gas resources and proficient human resources.

The Islamic Republic is a very secure country and owes this security to its people and not to foreigners, he said.

Speaking in an exclusive interview with IRNA correspondent in London, Schweitzer commented on the future of trade relations between Iran and the West.

He noted that the two sides relationship is ‘very good on personal level. On political level I would also say it is good. It is an issue of implementation.

There is a lot of good intensions on all side but it is also a very complicated affair.’

I think one should contend oneself with individual successes and the arrangements will take time. We also see a lot of activity from our side. We import gas turbines, we help international companies to buy shares in Iranian companies. It is a great opportunity for industrial companies and service companies who want to be active. We facilitate imports which still is a big problem because of the payment restrictions. So all is a little bit more difficult but everything is doable if you do it correctly.’

Commenting on the obstacle in improving trade relations between the two sides, Schweitzer said, ‘The biggest issue is that all LC system only works with individual banks. So you cannot use the older big banks for large transactions, then the primary sanctions with the US are still there.

So companies who have US activity are still a bit shy. So it is an issue of perception not necessarily of risk.’

Asked about the possible risks for the banks that are to trade with Iran, the Arjan Capital Ltd official said, ‘A Bank will be fined because they made some transactions and the Americans consider this was not appropriate and then they are fined again think these banks they don’t want to even think about it anymore because the opportunity is not so big.’

As for the small banks starting to do business with Iran, he noted, ‘There are very few regional banks, some banks have even opened offices in iran. It will develop, this level is still pretty good. You can do a few hundred million turnover which is, I think, six months after the JCPOA (Joint Comprehensive Plan of Action). It is a good result. This is very positive to me. But one should not think things will happen very very fast.’

Commenting on US government’s different policy towards Iran, Schweitzer said, ‘You have different voices but you also don’t know what government you are going to have. We are going to know more when the elections are done. But until the new secretary of state is in place I don’t think there is going to be a real clarity. I do not blame anybody who does not act, regardless of what the Americans suggest. But this is good for Europeans and I am not complaining. People who want to invest in Iran wants to see clarity in America regardless of who is the next president

They just want to know what is the situation. So much is said before the election and things are different after the election. All I would say is lets just wait to see how things are

The Austrian banks are intended to return to the Islamic Republic, Stift said on Monday in the Iran-Austria business forum held at the Tehran Chamber of Commerce, Industries, Mines and Agriculture, referring to the post-sanctions era and reestablishment of banking ties between Iranian and foreign banks.

‘The establishment of Austrian banks’ subsidiaries in Tehran is going to help promote economic ties between Austria and Tehran,’ he said.

The Austrian ambassador to Iran also referred to recent visit by Iran’s Central Bank governor to Austria and expressed hope that Vienna and Tehran would see enhancement of bilateral ties in the near future.

Italy’s Carlo Maresca on Saturday signed a $100-million contract with the Iranian organization to construct a solar power plant near Garmsar Special Economic Zone in the central province of Semnan. As per the deal, a 100-megawatt will be built on a 2,000-hectare area within 15 months, IDRO’s official website reported….

Iran says credit line with Russia to boost trade Iran’s Minister of Economy and Financial Affairs Masoud Karbasian. Iran says it expects a recent agreement with Russia over the creation of a credit line to fund Iranian projects to help promote trade between the two countries. Iran’s Minister of Economy…

Iran huge rise in imports from Europe Iran has reported a major rise in imports from several key European countries over a period of nine months starting 21 March 2017. As Iran is celebrating the second anniversary of the removal of sanctions, figures show the country’s imports have been picking…

Iran opens third DRI steel mill using domestic technology Neyriz Steel Complex at the time of commissioning. Iran has brought online its third steel plant which uses domestic technology for production of direct reduced iron (DRI) or sponge iron. The hot commissioning of Neyriz Steel Complex in the southern Fars…

With better risk rating, Iran now stands next to Brazil The Organization for Economic Cooperation and Development (OECD) has improved Iran’s risk rating by one notch. Iran’s media are reporting that the country’s risk classification has improved by one notch in a vital sign of improved investment environment. The English-language…

PSA invites Iran Khodro to produce Peugeots in Algeria Iran Khodro logo French carmaker PSA Group has invited Iran Khodro (IKCO) to set up a production line for Peugeot cars in Algeria, the Islamic Republic News Agency (IRNA) reports. PSA executive vice-president for purchasing, Yannick Bézard, on Tuesday visited Tehran-based…

Just define your interests, We will promote the best investment opportunities for you